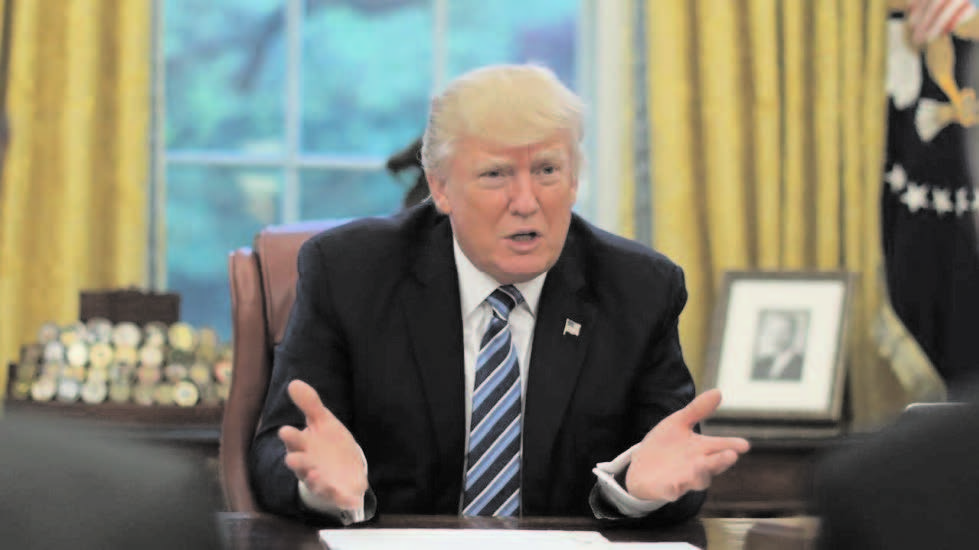

NEW YORK (TIP): Four Donald Trump-licensed real estate developments are at the center of a huge income tax evasion scheme, according to allegations in a lawsuit unsealed Thursday, July 14 afternoon by a judge in Manhattan.

The presumptive Republican nominee is not personally accused. He is described as a “material witness” in the evasion of taxes on as much as $250 million in income. According to the court papers, that includes $100 million in profits and $65 million in real estate transfer taxes from a Manhattan high rise project bearing his familiar name.

However, his status may change, according to the lawyers who filed the lawsuit, Richard Lerner and Frederick M. Oberlander, citing Trump’s testimony about Felix Sater, a convicted stock swindler at the center of the alleged scheme.

Trump received tens of millions of dollars in fees and partnership interests in one of the four projects, the Trump Soho New York, a luxury high rise in lower Manhattan. His son Donald Junior and his daughter Ivanka also were paid in fees and partnership interests, the lawyers said, and are also material witnesses in the case.

Trump and Sater traveled extensively together and were photographed and interviewed in Denver and Loveland, Colo., Phoenix, Fort Lauderdale and New York. The two Trump children were also with Sater in Moscow, Alan Garten, the Trump Organization general counsel, has said.

Trump has testified about Sater in a Florida lawsuit accusing the two of them of fraud in a failed high-rise project. Trump testified that he had a glancing knowledge of Sater and would not recognize him if he were sitting in the room.

Sater controlled an investment firm named Bayrock, with offices in Trump Tower, and sought to develop branded Trump Tower luxury buildings in Moscow and other cities. Court papers show his salary in 2006 was $7 million, but it alleges that was a pittance compared to his real income.

Sater then moved into the Trump Organization offices. He carried a business card, issued by the Trump Organization, identifying him as a “senior adviser” to Trump.

The tax fraud lawsuit included 212 pages of documents, among them a flow chart that the plaintiff claims showed how the scheme worked. The lawsuit alleges the tax fraud scheme as simple, telling the judge “there need be no fear of complexity, for there is none.”

Be the first to comment