A unanimous resolution should have been adopted by both Houses against Pak terror. It would have been a signal of India’s unity on terror.

Was it too much to hope that after all the political point-scoring on the Pahalgam attack and Operation Sindoor was done, a unanimous resolution would have been adopted by both Houses of Parliament against Pakistani terror? A resolution would have been a natural corollary to the sending out of the seven all-party delegations to show that India stood together after the Pahalgam attack and had endorsed the government’s kinetic action.

It would have also been a potent signal to the international community that the unity displayed by India’s political class on Pakistani terror was not ephemeral but a reflection of national determination. Alas, the thought of a resolution did not even cross the minds of our leaders, whether in government or opposition; such is our current polarized polity.

Consequently, the special parliamentary discussion did not rise above party politics. It became mainly an exercise in political declamation, of levelling accusations and counter-accusations, of evasion and silence. Of course, Parliament is quintessentially a political platform, but it is also the highest constitutional forum for serious debate to forge a national strategic consensus on security issues. This discussion gave a chance to leaders for an intense, constructive probing of these vital matters.

Some strategic concerns were raised by the opposition — such as the nature of Sino-Pak nexus and its impact on India’s defense. Instead of responding positively, the ruling dispensation decided to regurgitate all the mistakes made by the Nehru-Gandhis. Thus, these issues were lost in an avalanche of rhetoric, which was only occasionally punctuated by some important diplomatic and strategic points. Perhaps, the most significant were made by PM Modi on India’s position on the Indus Waters Treaty. The operationalization of India’s intentions will not be easy for the rivers allotted to Pakistan under the treaty, except for the Chenab.

It was legitimate for the Opposition to ask questions relating to the security and intelligence aspects of the attack. After all, the terrorists freely roamed the Baisaran valley on April 22 for over an hour, killing 26 men at will. The government did not respond to these queries but took credit for the elimination, just a day before the discussion, of three of the Pakistani perpetrators. The security forces did a good job in killing these men, but the questions on the absence of security will not go away with their avoidance by the rulers.

The government also maintained a stony silence on the global narrative that India had lost aerial platforms on the first day of Operation Sindoor. The Opposition pressed in vain for it to come clean. The government could have chosen to adopt the valid position taken by the Indian military that despite some initial losses, it was able to decisively find pathways through Pakistani aerial defenses to strike nine of its airbases. Clearly, Modi sought to bypass the question when, in somewhat colorful language, he reported how abjectly the Pakistani Director General of Military Operations (DGMO) asked his Indian counterpart to end hostilities. This may appeal to a section of the ruling dispensation’s faithful, but would not put to rest the global narrative that India did not gain a decisive military edge over Pakistan in Op Sindoor. Modi’s revelation that India neutralized Pakistan’s aerial attack on May 9-10 was useful, but would it contribute to correcting international perceptions on Operation Sindoor?

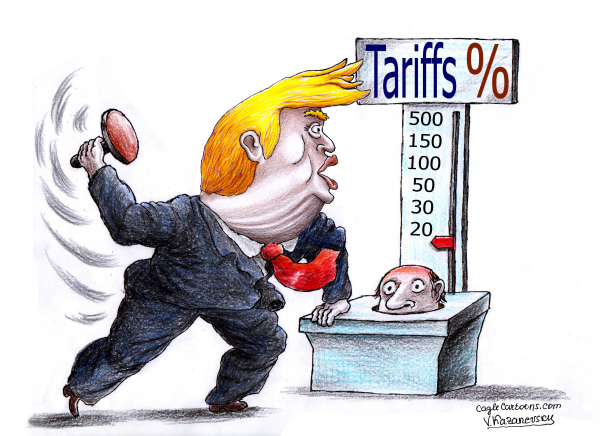

The government avoided direct refutation of US President Donald Trump’s claims of mediating between India and Pakistan. External Affairs Minister S Jaishankar clarified that there was no conversation between Trump and Modi from April 22 to June 17. That, of course, proves nothing. Modi asserted, “No world leader had asked India to pause Operation Sindoor.” While no country may have specifically used such a formulation, in all their conversations with their Indian counterparts, the representatives of major powers were wanting armed India-Pakistan hostilities, which began with Operation Sindoor, to end.

What India needs to conclusively establish is that an unacceptable terrorist attack by one nuclear state on another is the first step on the escalatory ladder; hence, Pakistan must strike out the use of terror against India from its security doctrine. Regrettably, this most important strategic point was not unequivocally stated by any ruling dispensation speaker. It was equally important for the Opposition to have endorsed it. But that would have required backroom discussions to be held prior to the debate on the message that should go out to the nation and world from the Parliamentary debate. Obviously, no such conversation took place.

Jaishankar said this about India’s future approaches towards Pakistan: “There is now a new normal. The new normal has five points: One, terrorists will not be treated as proxies. Two, cross-border terrorism will get an appropriate response. Three, terror and talks are not possible together. There will only be talks on terror. Four, not yielding to nuclear blackmail. And finally, terror and good neighborliness cannot coexist. Blood and water cannot flow together.”

Apart from a few sections of the political class who favor that the doors of dialogue with Pakistan should not be shut, the points mentioned by Jaishankar enjoy wide acceptance with the Indian people. A parliamentary resolution containing these issues, with an appropriate part regarding India’s desire for good ties with Pakistan but that it needs to abandon terrorism, would have found acceptance with all sections of Parliament. That is what should have emerged from these discussions. It would have carried global credibility. But that needs a political leadership, which despite political bickering, is in conversation on major national issues. That seems absent today.

(Vivek Katju is a retired diplomat)