The Reserve Bank of India (RBI) is proposing expanding the reach of the popular Unified Payments Interface (UPI) digital payments system by allowing credit to be offered via pre-approved bank lines. “This initiative will further encourage innovation,” RBI governor Shaktikanta Das said on Thursday during the announcement of the central bank’s monetary policy decision. UPI is an instant real-time payments system that allows users to transfer money across multiple banks without disclosing bank account details. Its popularity is seen to have reduced the usage of cash and debit cards for daily transactions. In March 2023, UPI recorded 8.65 billion transactions, amounting to 14.05 trillion rupees, its highest-ever since inception, data from the National Payments Corporation of India showed. In a bid to boost digital payments, the RBI recently allowed RuPay credit cards to be linked to UPI. This was to enable customers to link their credit cards and pay via UPI

Related Articles

India

3 walk free in Hathras rape and murder

A court in Hathras has found only one of the four accused in the Hathras brutalisation and death of a Dalit girl guilty and exonerated the others, who have been in jail since September 2020, […]

NY/NJ/CT

Meet the Forbes Seven richest Indian Americans

NEW YORK (TIP): Forbes recently released its list of 400 wealthiest Americans for the year 2021. Seven Indian Americans, with a combined net worth of $42.4 billion, have made it to the list — the same […]

Book Festival

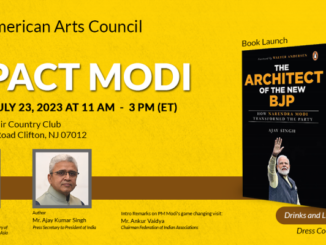

GROUNDBREAKING EVENT HIGHLIGHTING THE ARCHITECT OF THE NEW BJP

Jul 20, 2023 - 1:18 am EDT

@theindpanorama

Book Festival, culture and literature, Featured, NJ Events

1

By Mabel Pais Impact Modi: a groundbreaking event dedicated to igniting change and transformation, takes place on Sunday, July 23, 2023 at the prestigious Upper Montclair Country Club, 177 Hepburn Rd Clifton NJ 07012. With […]

916113 361639I agree along with your points , fantastic post. 289560