NEW DELHI (TIP): The government is likely to introduce a disclosure scheme under which anyone with unaccounted income can come clean by paying 50% tax before December 30.

A fourth of the amount remaining after taxation will be locked in for four years, top officials told DH on Friday.

They said the government was bringing in an amendment to the Income Tax Act in the current session of Parliament.

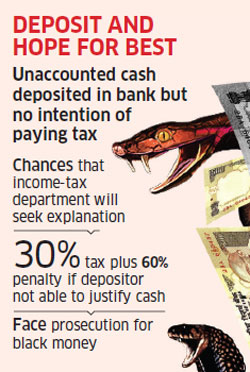

The move is intended to ensure black money does not come back into circulation after tax is paid on it. Only 25% of the total disclosed amount will be available for use. Those with unaccounted-for cash who disregard this option will face a stiffer penalty if caught subsequently. They will have to pay 90% of the income, 30% being tax and 60% penalty.

The amendments, cleared by the Cabinet, have been sent to the President for his assent and are likely to be introduced in Parliament next week, the sources said.

On November 9, the government had said it would treat cash deposits exceeding Rs 10 lakh, and not matching declared income, as income on which tax had been evaded.

It said such an amount would attract as penalty 200% of the tax payable.

However, the proposal was criticised on the grounds that such steep penalties could not be imposed on individuals without an amendment to the tax laws.

The government is also planning to include a clause in the IT Act to provide a permanent window to tax undisclosed income at a rate higher than that imposed under the Income Disclosure Scheme, which ended on September 30.

Be the first to comment