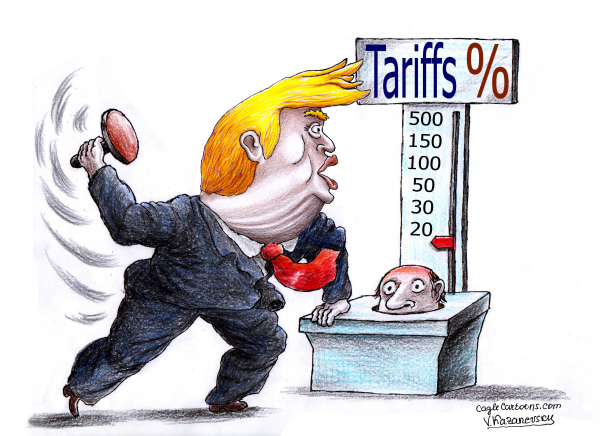

The recent pronouncements by the United States regarding the potential imposition of a 25% tariff on all Indian imports, coupled with an unspecified “penalty” tied to India’s energy purchases from sanctioned countries like Russia or Iran, signal a significant shift in bilateral relations. This aggressive stance carries profound strategic, economic, and diplomatic implications for both nations. This analysis delves into the potential gains and losses, supported by market data and strategic considerations.

For India: Potential Losses and Mitigating Factors

The direct economic impact of a 25% tariff on India’s exports to the U.S., which stood at approximately $87 billion in 2024, cannot be overstated.

- Export Disruption and Economic Headwinds:

- Reduced Competitiveness: A 25% tariff would immediately erode the price competitiveness of Indian goods in the U.S. market. Sectors particularly vulnerable include:

- Textiles and Apparel: India is a major exporter of textiles, and a tariff would disadvantage its products against those from countries with lower or no tariffs, potentially leading to job losses in this labor-intensive sector.

- Pharmaceuticals: India is globally recognized as the “pharmacy of the world,” supplying 20% of global generic medicines by volume and 40% of generic demand in the United States. With the U.S. accounting for over 30% of India’s pharma exports, the inclusion of pharmaceuticals in the tariff bracket would be particularly damaging. Disruption here could not only impact India’s export earnings but also global drug supply chains. Presently this segment seems to be out of tariff list.

- Gems and Jewelry: This sector relies heavily on the U.S. market, and tariffs could significantly reduce demand.

- Auto Parts: As part of global automotive supply chains, Indian auto parts exports would face competitive challenges.

- IT Services: While less directly impacted by goods tariffs, broader trade tensions could affect outsourcing contracts and investor sentiment in India’s IT sector.

- GDP Impact: Economists at ICRA have indicated that such a tariff, being higher than previously anticipated, is “likely to pose a headwind to India’s GDP growth.” While specific percentage points are hard to predict without the exact scope and duration, significant disruption to a major trading partner would undoubtedly exert downward pressure on economic expansion.

- Job Losses: Export-oriented industries, especially labor-intensive ones, would likely face contraction, leading to potential job losses.

- Investor Confidence Erosion:

- Trade instability and escalating diplomatic tensions can deter foreign direct investment (FDI) into India. Investors seek predictability and stable policy environments, and recurring tariff threats undermine this confidence. This could impact not only new investments but also expansions by existing foreign companies in India.

- Energy Security Penalties and Geopolitical Constraints:

- Disruption of Energy Contracts: The “penalty” linked to energy purchases from sanctioned nations like Russia and Iran directly targets India’s energy security strategy. India’s reliance on Russian oil has surged dramatically, now accounting for 35-40% of total crude imports, up from a mere 0.2% before the Russia-Ukraine war. This surge was primarily driven by attractive discounts (e.g., Urals crude trading at a substantial discount to Brent). Penalties could disrupt long-term contracts, forcing India to seek more expensive alternative sources, thus increasing its energy import bill and inflationary pressures.

- Risk of Secondary Sanctions: The U.S. has a history of imposing secondary sanctions on entities dealing with sanctioned countries. While India has largely navigated these, an explicit “penalty” suggests a more direct attempt to curtail these purchases, potentially impacting Indian refiners like Nayara Energy (which has already faced EU sanctions-related challenges).

- Limited Strategic Autonomy: U.S. pressure to conform to Western sanctions, particularly on energy, could be perceived as an attempt to limit India’s strategic autonomy in foreign policy and energy diplomacy. This is a sensitive point for India, which champions a multi-aligned foreign policy.

Potential Gains (Mitigating Factors & Strategic Shifts):

- Assertion of National Autonomy:

- Maintaining its stance on diverse energy sourcing, despite U.S. pressure, reinforces India’s image as a sovereign decision-maker. This could resonate domestically and with other nations seeking to resist external pressures.

- Accelerated Diversification of Export Markets:

- The tariff threat serves as a strong catalyst for India to intensify efforts to diversify its export markets. This strategy is already underway with ongoing negotiations for Free Trade Agreements (FTAs) with regions like the UK (where the India-UK FTA is expected to significantly boost agricultural exports) and the EU, alongside a focus on Southeast Asian and African markets. This proactive diversification would reduce over-reliance on any single market. Indian electronic contract manufacturers, for instance, are already expanding globally through acquisitions to capitalize on supply chain shifts away from China, aiming to broaden their client base beyond the U.S.

- Boost to Domestic Industry and “Make in India”:

- Reduced access to the U.S. market could prompt Indian producers to focus more on domestic demand, fostering the “Make in India” initiative. This could strengthen local supply chains and industrial capabilities.

- The Indian government’s “Production Linked Incentive (PLI)” schemes for various sectors, including pharmaceuticals and electronics, are already designed to boost domestic manufacturing and reduce import dependency, aligning with this potential shift.

For the United States: Potential Gains and Losses

The U.S. seeks to use these measures as leverage but faces significant risks to its broader strategic objectives.

- Potential Gains:

- Diplomatic Leverage and Policy Alignment: The tariff threats serve as a powerful diplomatic tool to pressure India into closer alignment with U.S. foreign policy objectives, particularly regarding sanctions against Russia and Iran.

- Protectionist Objectives: Higher tariffs could offer short-term protection to specific U.S. domestic industries, such as textiles or chemicals, from Indian competition. This aligns with a broader protectionist trade agenda.

- Geopolitical Messaging: A strong stance against India’s energy purchasing decisions sends a clear message to other allies and partners about the potential consequences of defying U.S. sanctions or strategic priorities. This reinforces the perception of U.S. leadership in global economic governance.

- Potential Losses:

- Damage to Bilateral Relations and Strategic Alliance: Imposing tariffs and penalties risks significantly straining the strategic partnership between the U.S. and India. At a time when the U.S. is actively seeking to counterbalance China’s influence in the Indo-Pacific, alienating a key partner like India could undermine its regional strategy and the Quad alliance.

- Retaliatory Tariffs: India has historically responded to U.S. trade actions with its own tariffs. While Indian officials have indicated caution, retaliatory tariffs on U.S. agricultural exports (e.g., almonds, apples), Harley-Davidson motorcycles, or technology firms (like Amazon, Apple, Google, which have significant investments in India) are a real possibility. This could hurt U.S. exporters and consumers.

- Economic Backlash for U.S. Companies: Major U.S. companies with substantial investments and market presence in India could face significant regulatory hurdles, public backlash, or reduced demand. This includes tech giants, e-commerce platforms, and fast-food chains.

- Supply Chain Disruptions: India is an integral part of several global supply chains, particularly in pharmaceuticals and IT services. Disruptions caused by tariffs could negatively impact U.S. importers of Indian goods and services, potentially leading to increased costs and supply shortages. For instance, India accounts for a significant portion of the U.S.’s generic drug supply, and tariffs could lead to higher drug prices or availability issues.

- Increased Inflation for U.S. Consumers: As noted by economists, a 25% tariff means that U.S. importers will likely pass on a significant portion of these increased costs to American consumers, leading to higher prices for a range of goods. The Washington Center for Equitable Growth analysis suggests such policies could raise US manufacturers’ costs by 2% to 4.5%, ultimately passed on to consumers.

Strategic Outlook and Market Analysis

The current threat of tariffs and penalties is widely perceived as a negotiating tool rather than a definitive policy. The August 1st deadline set by the U.S. appears to be a lever to expedite a bilateral trade agreement with India, which has been under negotiation for months. Indian Commerce and Industry Minister Piyush Goyal has stated that India’s priority is to protect national interests, particularly those of farmers, entrepreneurs, and MSMEs, and that India will not negotiate under deadlines.

- India’s Resilience: India’s cautious approach to trade negotiations, learning from challenges in U.S. agreements with Japan and other nations, indicates a commitment to securing beneficial terms rather than rushing a deal. India’s recent success in finalizing the Comprehensive Economic and Trade Agreement (CETA) with the UK demonstrates its capability to strike significant trade deals.

- U.S. Strategic Imperatives: The U.S. faces a critical balancing act. While seeking to exert influence over India’s energy choices and trade policies, it must weigh the significant cost of alienating India, a burgeoning economic power and a crucial strategic partner in its Indo-Pacific strategy aimed at countering China. The U.S. also stands to gain from India’s growing energy demand, with U.S. LNG exports to India reaching a record 19% of India’s total LNG imports in 2024.

- Bilateral Trade Imbalance: The U.S. ran a $45.7 billion trade deficit in goods with India last year, importing more than it exported. This imbalance is a key driver behind the U.S.’s protectionist stance.

- Temporary Measure? Indian government sources anticipate that any imposed tariffs would be a temporary measure, given the progress of ongoing trade talks, with a U.S. delegation expected in Delhi by mid-August for further discussions. The aim remains a comprehensive bilateral trade agreement by October-November.

In conclusion, while the immediate threat of tariffs creates uncertainty and potential economic headwinds for India, both nations have significant incentives to de-escalate tensions and reach a mutually beneficial trade agreement. The broader geopolitical landscape, particularly the need for a strong Indo-Pacific alliance, will likely steer the U.S. towards a resolution that avoids a severe and lasting rupture in relations. India, meanwhile, continues to strategically diversify its trade and energy partners, strengthening its resilience against external pressures.

(H S Panaser: Chair, Global Indian Trade and Cultural Council, Consultant Business Development: Pharmaceuticals, IT, Healthcare and AI, EDP Project Management, President, Global Indian Diaspora Alliance, Prof. Harkishan Singh Foundation, Columnist)

Leave a Reply