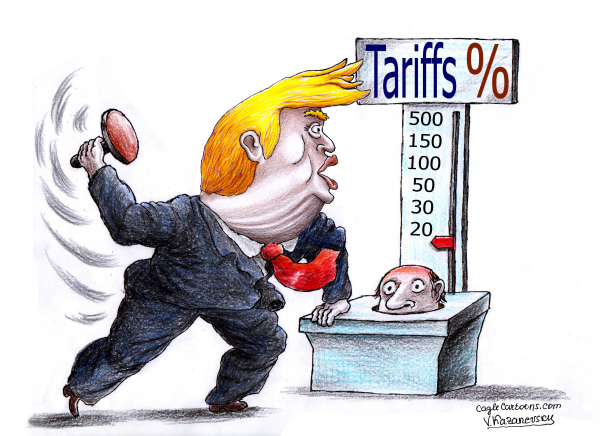

“The imposition of steep U.S. tariffs on Indian goods in 2025 marks a new chapter in bilateral trade tensions. While the tariffs primarily target labor-intensive goods such as textiles, gems, and leather, technology services—which underpin India’s STEM workforce—remain exempt. The broader risks to Indian IT professionals arise from tightening U.S. visa policies, macroeconomic uncertainty, and automation trends. India’s growing domestic technology ecosystem, along with market diversification and the expansion of Global Capability Centers (GCCs), provides resilience. Long-term challenges, however, include skills mismatches and an oversupply of graduates.”

In August 2025, the United States imposed a 50% tariff on a wide range of Indian goods, citing India’s continued purchases of Russian oil. Although pharmaceuticals and technology services were exempt, the move strained relations between the two democracies.

India–U.S. trade in 2024 stood at $212.3 billion, with goods trade totaling $128.9 billion and services trade at $83.4 billion. The U.S. goods deficit with India rose to $45.8 billion in 2024, while services trade remained roughly balanced. Against this backdrop, tariffs represent both an economic and geopolitical flashpoint.

Key Impacts

Trade & Economy

- Tariffs on Indian goods increase costs for American companies in labor-intensive sectors, potentially reducing discretionary spending on IT services.

- Indian exports in textiles, leather, and gems face near-term declines, with ripple effects on employment in those industries.

STEM Employment in India

- Direct impact on IT jobs is limited, as technology services are exempt from tariffs.

- Indirect effects include slower growth in IT projects due to weaker U.S. business sentiment.

- Global Capability Centers (GCCs) remain strong, with American firms continuing to hire aggressively in India.

STEM Employment in the U.S.

- The larger challenge comes from tightening H-1B visa policies, which could increase wage requirements and prioritize higher-paying roles.

- Indian IT professionals face rising competition in a saturated U.S. job market, along with layoffs in major tech firms.

- Automation and AI adoption threaten entry-level coding jobs, shifting demand toward advanced roles in AI integration, cloud computing, and cybersecurity.

Visa & Policy Issues

- H-1B restrictions add uncertainty for Indian students and graduates in the U.S.

- Some Indian professionals may increasingly turn to Canada, the U.K., or Australia, which offer more favorable immigration policies.

Opportunities for India

- Domestic Technology Growth: India’s IT sector is expanding rapidly, with government initiatives like Digital India and foreign investment in AI and semiconductor hubs.

- Market Diversification: New trade agreements with the U.K., UAE, Australia, and talks with the EU reduce reliance on the U.S. market.

- Global Capability Centers: GCCs remain the biggest source of new tech jobs, offering global exposure and competitive salaries.

- Upskilling Momentum: Industry-led reskilling programs are addressing gaps in AI, machine learning, and cybersecurity.

Challenges & Risks

- Skills Mismatch: Despite producing millions of STEM graduates annually, many lack high-demand skills in data science, AI, and advanced analytics.

- Oversupply of Graduates: The volume of STEM graduates far exceeds immediate demand, pushing many to seek opportunities abroad.

- Geopolitical Uncertainty: U.S.–India trade frictions could worsen, creating long-term instability in cross-border tech collaboration.

- Automation Pressure: Rapid adoption of AI reduces demand for routine IT jobs, forcing constant adaptation.

Impact of AI on IT Job profiles in India and the U.S

India

- Massive job displacement underway—India’s IT and BPO sector, which employs millions, faces major disruption. Up to 30% of roles in writing, coding, and imaging may be impacted by AI by 2030, including around 640,000 low‑skilled service jobs, while growth in higher-skilled roles will lag behind.(Wikipedia)

- Acute skills shortage—For every 10 generative AI roles, there’s just one qualified engineer in India, highlighting a yawning gap between demand and talent.(The Times of India)

- Call center transformations—AI tools like accent-correcting software and co-pilot assistants are enhancing efficiency, but also displacing entry-level roles. Industry leaders stress reskilling in empathy and communication to preserve human-centric value. (The Washington Post)

- TCS takes action—Tata Consultancy Services (TCS) has formed a dedicated AI & Services Transformation Unit, signaling a strategic pivot toward AI-driven solutions even as the firm clusters layoffs.(Reuters)

- HCL Tech’s approach—HCL is employing AI to augment rather than replace jobs, investing heavily in upskilling: 217,000 employees completed 8.6 million training hours to stay relevant in an AI-first world. (The Times of India)

United States

- Entry-level job losses—A Stanford study found that young U.S. workers (ages 22–25) in software development and support roles saw nearly a 20% drop in employment by mid-2025, while older professionals saw gains—highlighting AI’s uneven impact across age and skill levels. (TechRadar)

- Salesforce slashes support jobs—Salesforce cut 4,000 customer support roles (~45% of its team), as AI agents took over routine tasks, though human oversight remains essential.( The Times of India and San Francisco Chronicle)

- AI complementing, not replacing—U.S. labor leadership stresses AI is a tool—not a threat. Workforce training initiatives under initiatives like “America’s AI Action Plan” emphasize reskilling and AI literacy to prepare workers. (New York Post)

- Skill demand shifting—Recent research highlights a surge in demand (and wage premiums) for AI‑complementary skills like digital literacy, teamwork, and resilience—while purely routinized roles face decline. (arXiv)

- Generative AI boosts productivity—but raises concern—A study shows 97% of IT staff use tools like ChatGPT, which significantly boosts productivity—but also correlates strongly with growing job security anxiety. (arXiv)

In both countries, AI is aggressively transforming job profiles—eliminating routine roles while creating a premium on AI‑integrated, human‑intensive skills. Upskilling is key to survival and success.

Conclusion & Recommendations

The U.S.–India tariff dispute is unlikely to directly reduce India’s STEM employment, as technology services remain exempt. However, the real risks lie in tightening U.S. visa policies, weaker client spending, and automation.

India can mitigate these challenges by:

- Accelerating upskilling programs in AI, cloud, and cybersecurity.

- Expanding domestic digital projects to absorb STEM graduates.

- Strengthening alternative export markets to reduce reliance on U.S. demand.

- Encouraging companies to leverage GCCs as hubs of innovation, not just cost centers.

By focusing on resilience, diversification, and skills development, India can turn trade friction into an opportunity for long-term leadership in global technology.

References

- Office of the U.S. Trade Representative (2025)

- NDTV, Times of India, Al Jazeera (2025)

- Center for Strategic and International Studies (CSIS), Newsweek (2025)

(As a columnist, H.S. Panaser brings a wealth of experience in global business, technology, and trade. He is the Chair of the Global Indian Trade and Cultural Council and President of the Global Indian Diaspora Alliance, with a deep understanding of the U.S.-India relationship. His expertise as a consultant in Global Business Development, Pharmaceuticals, and AI in Healthcare provides a unique and informed perspective on current events. Gitcc.USA@gmail.com)